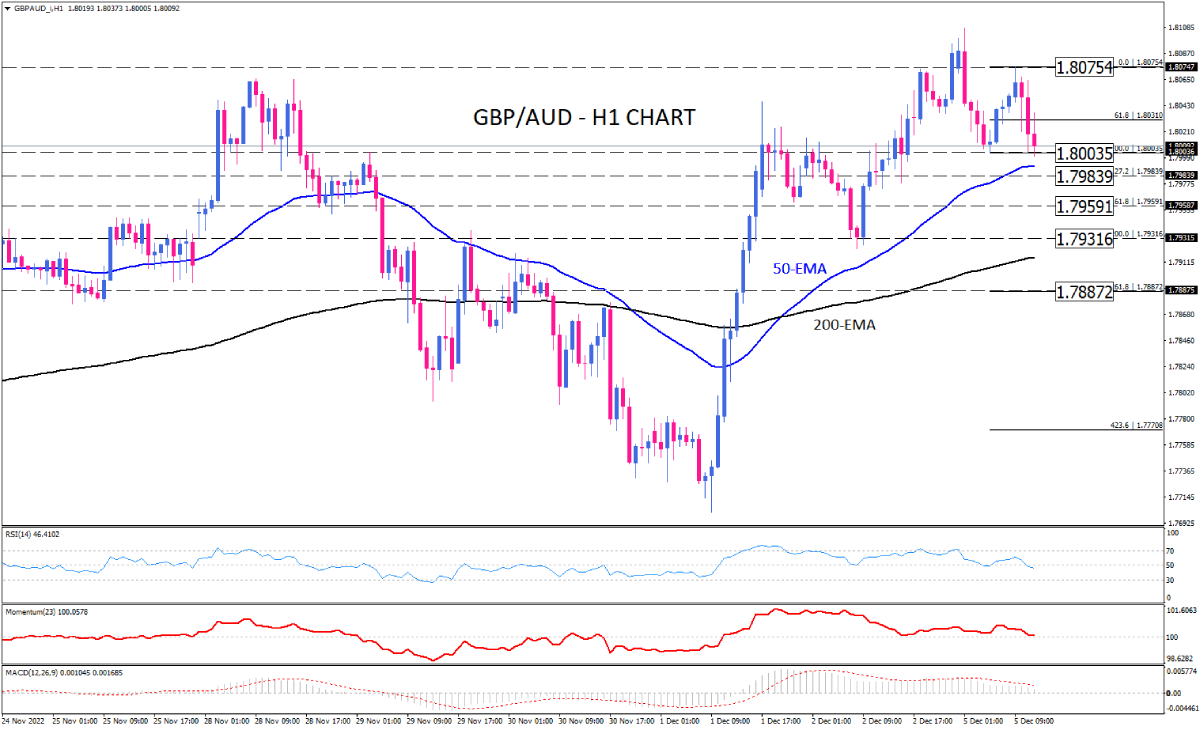

GBP/AUD bears in spotlight at the verge of 1.80 key support

As seen on the one-hour chart, the GBP/AUD rally has lost steam since sellers topped at 1.81 earlier Monday, which prompted declines towards the 1.80 key support line. Sellers are attempting to tackle this barrier for the second time in the session which is more likely to result in triggering a new downward correction with emerging the 50-EMA on the horizon. If that is the case, prevailing selling pressure can push down the price to land at the 1.79839 mark. Breaking this obstacle will bring 1.79591 to the seller’s attention. In the event that this hurdle, also, fails to hold support, GBP/AUD may witness falling towards the low of December 2 at around 1.79316, which lines up with the 200-EMA.

Otherwise, should buyers take the lead again on a clue from the 1.80 psychological level, the pair can pare some losses towards 1.80754. Nevertheless, a decisive break of this barricade will be necessary for resuming the rally further.

Momentum oscillators imply a tepid picture in short term. RSI is crawling in the neutral zone, beneath the 50-level. Momentum is struggling to bounce off the 100-threshold. And MACD bars are still posting positive values although they are shrinking toward zero.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.