GBP/AUD breakout puts the price on the back foot

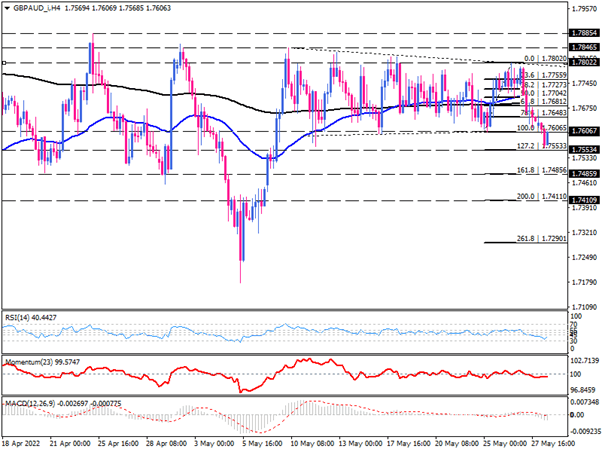

In recent weeks, the GBP/AUD pair traded in a pure range between the 1.78020 resistance and the 1.76065 support. However, a break below the range support on Monday put the pair on the back foot, with the pair now aiming to find immediate support near the 1.75533 mark, which is in line with the 1.272% Fibonacci level. With bearish momentum persisting, sellers may find sufficient strength to pass this hurdle, which may further lower the price towards the 161.8% Fibonacci level of the last upswing, aligned with the 1.748566 mark. By breaking through this obstacle, the downtrend could reach a lower target at 1.74110.

Conversely, suppose buyers successfully defend the 1.75533 level of support. In that case, they could aim for the 1.76065 level to retest the broken support turned resistance. If the pair sustains above this barricade, more buyers will enter, hoping to reach the confluence of flattening 50 and 200 EMAs, which are right in line with the 61.8% Fibonacci retracement of the previous upswing.

Momentum oscillators indicate a prevailing bearish bias. There is still room for the RSI to reach the 30 level even though it is trending downward in the selling area. Also, momentum is moving below the 100-threshold, and MACD bars are growing in the negative region. It is of note that the signal line recently crossed below the zero-line, signalling a further intensification of the downward trend.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.