GBP/AUD makes fresh weekly lows on BoE statement

In the aftermath of its November policy meeting, the Bank of England (BoE) announced that it had increased its policy rate by 75 basis points (bps) to 3% as a result of its policy meeting. According to the accompanying policy statement, the Bank of England expects the terminal rate to be lower than the current market expectations of 5.20%. Fresh selling around the GBP is prompted by this news, as well as a gloomy outlook for the UK economy puts pressure on the cable.

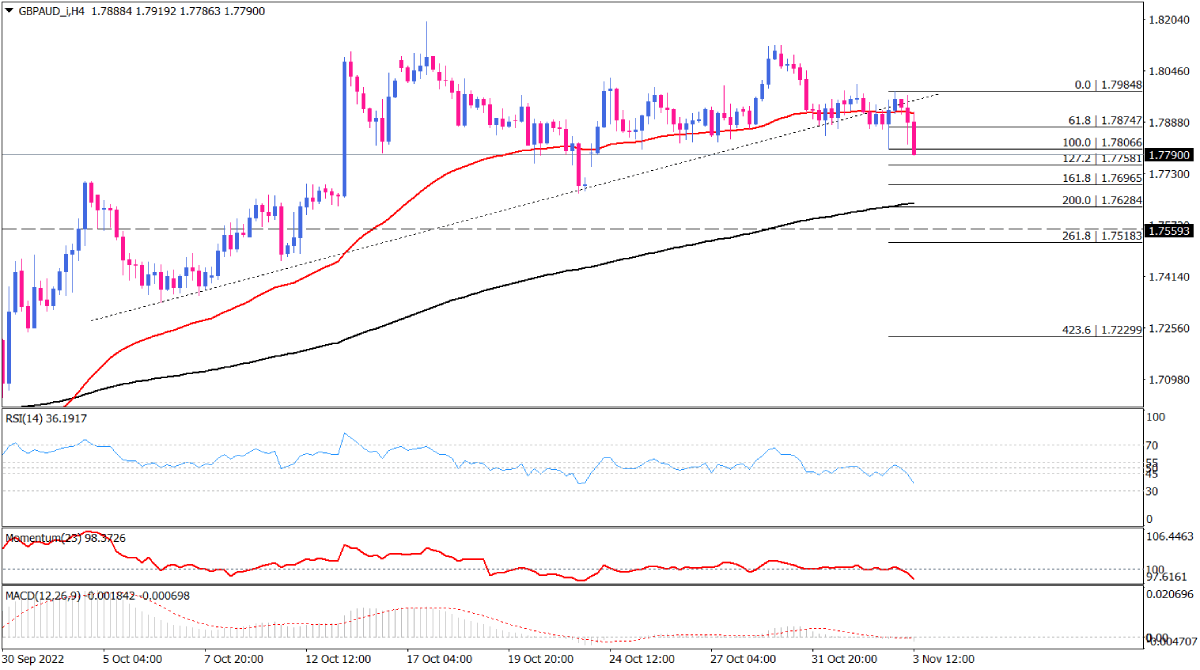

GBP/AUD on the four-hour chart is extending its slide, dropping below 1.78 for the first time in over a week.

Sellers are battling the 1.7806 barrier to keep the pair on a negative note after penetrating the one-month up trendline. If they manage to overcome this hurdle, immediate support will pose a challenge to further fall at 1.77581. A sustained move below this level can push the price to decline further towards the 1.76965 barricade. Suppose sellers maintain control and overcome this support level. In that case, the 200-EMA, which lines up with 1.76284, will be highlighted.

Alternatively, if selling pressure wanes, bulls will return to the market, targeting the broken trend line around the previous level of interest of 1.79848.

The bearish bias is supported by short-term momentum oscillators. RSI is pointing sought in the selling area. Momentum keeps falling after crossing its threshold at the 100-level. MACD has posted a crossover with the MACD bar and signal line both falling into negative territory.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.