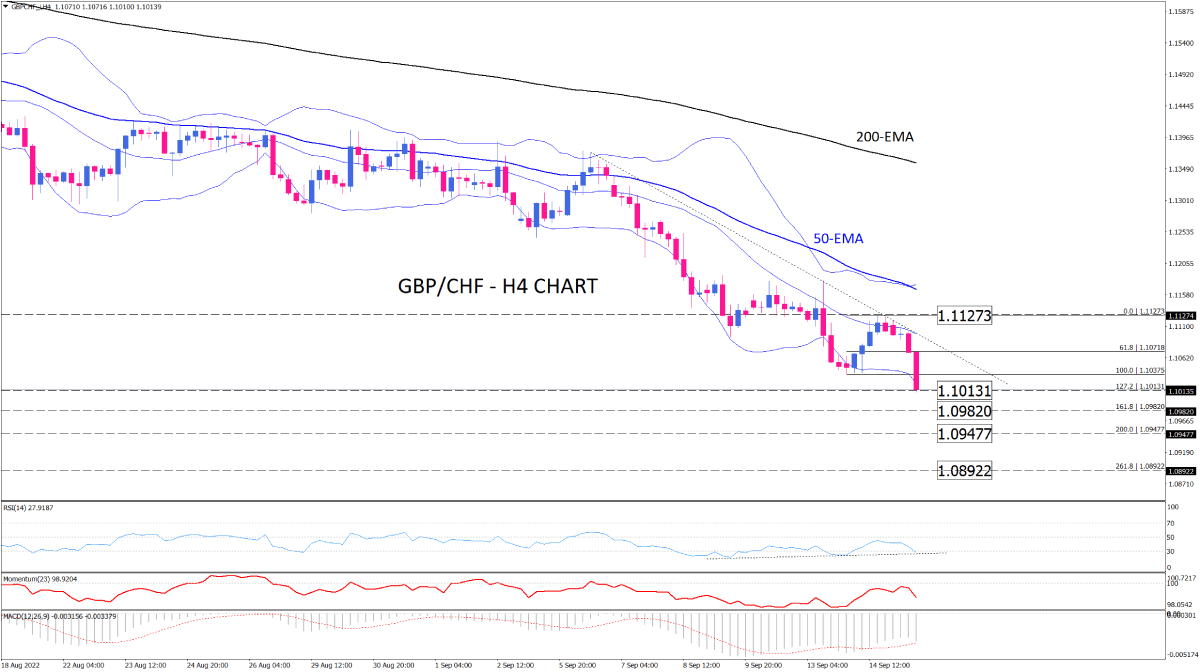

GBP/CHF sellers battling crucial support to retain downtrend

The downtrend in GBP/CHF was gaining speed on the four-hour chart as lower tops have resulted in a steeper trendline. The Bollinger bands also exhibit intensifying bearish momentum, with the bands widening and the price falling at the lower band. However, there appears to be a lot of pressure on sellers, as the RSI has entered the oversold zone. Following a break below the 1.10375 mark earlier in the session, the pair is currently being driven lower by cautious sellers in an attempt to reach 1.10131. Suppose they succeed in closing below this hurdle. In that case, more declines will be on the cards, and the subsequent support can be estimated at the 161.8% Fibonacci projection around 1.09820. Overcoming this level can lead the price to tumble towards 1.09477, which lines up with the 200% projection level of the prior upswing.

Otherwise, if GBP buyers set up their game, taking a cue from exhausted sellers, the GBP/CHF can be easing up on its decline. In that case, the pair may be back up to retest the former support around the 1.10375 handle and beyond. Even if they get there, bulls need to overstep the 1.11273 mark, breaking the downtrend line to reverse the trend.

It seems risky to bet on further declines since all three momentum oscillators indicate that the downtrend is stalling out. RSI has fallen down in the oversold area after posting a divergence with the price. Momentum also failed to make lower bottoms along with the lower bottoms on the price chart. Despite the MACD histogram showing a dip in the negative region, there is a clear divergence between the oscillator and the price.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.