GBP/USD sellers may pause in the short-term

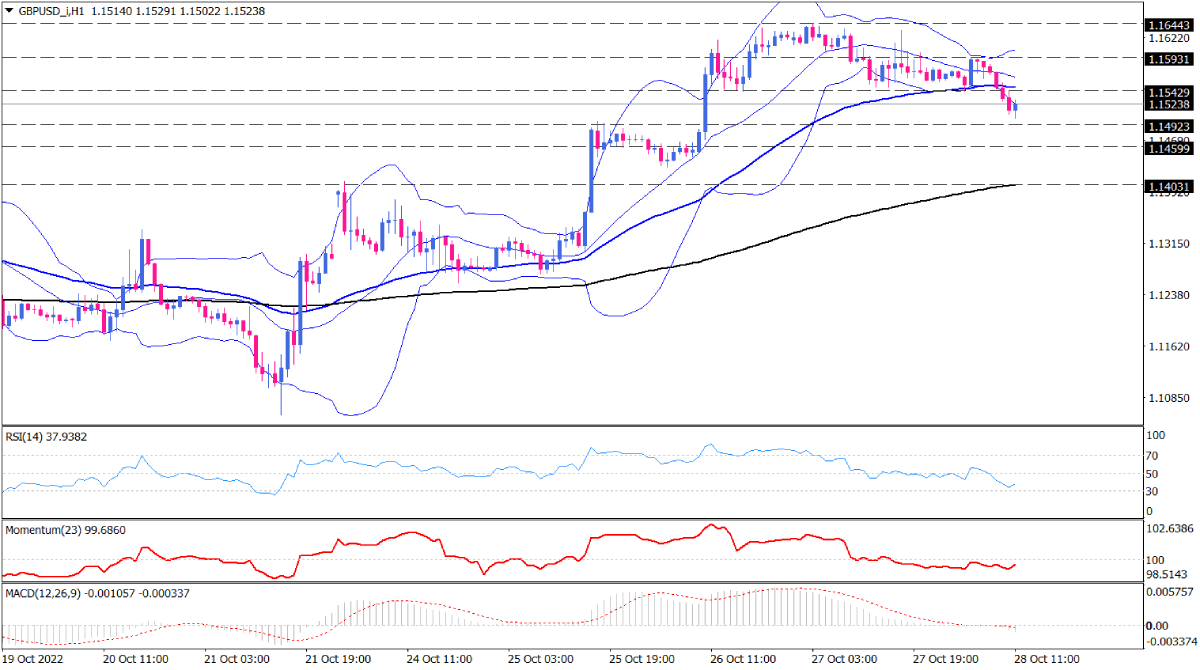

GBP/USD is headed lower on Friday with sellers crossing the 50-EMA on the hourly chart, breaking the 1.15429 barrier. After hitting five-week highs around 1.16443 buying pressure faded as bulls retreated from the peak to retest the 50-EMA in the light of beating US economic data, which supported the US dollar. At the same time, the Bollinger bands indicator is getting a steeper negative slope with the price falling in the lower half. Also, diverging bands indicate the negative momentum is intensifying. In addition, the middle band which represents the 20-period MA is going to cross the 50-period MA as another sign that the prior rally is out of steam.

Given that, further pressure from sellers can get the price to the 1.14923 hurdle as an immediate key level which has been tested before. A sustained break below this barrier will keep the pair in a bearish manner towards 1.14599. In the event that this level can’t provide sufficient support to buyers, more sellers may continue the downfall to meet the 200-EMA, which is located in a critical area of the 1.1400 psychological level.

On the flip side, should 1.14923 put a brake on the decline, the price will find a chance to keep up towards the 50-EMA, lining up with 1.15429. The short-term bearish outlook can only change depending on a clear break of the previous top at 1.15931.

Although MACD oscillates in a bearish following crossing the zero level, RSI is heading towards the 30-level, indicating that sellers may take a break soon if the oscillator falls into the oversold area. At the same time, momentum is pointing up from the selling zone, implying the bearish pressure is easing.

In conclusion, for the GBP/USD selling party to be ongoing, bears need to gain more strength below the 1.14923 mark.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.