Gold bulls hold near a key resistance level

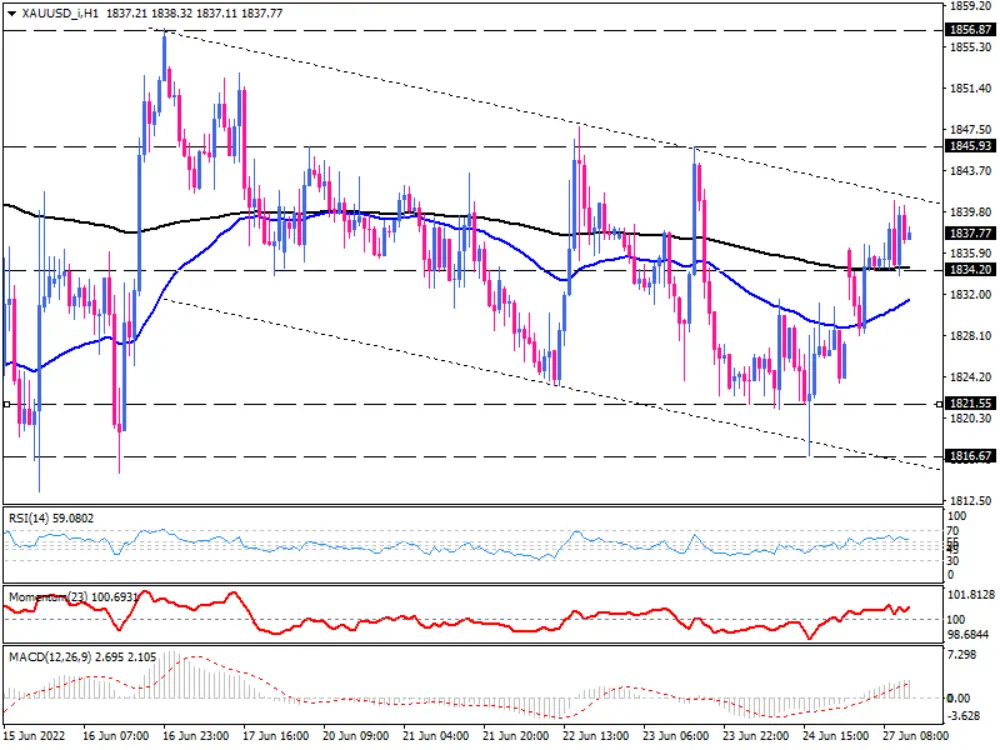

On the one-hour chart, we can see gold has been trading within a descending channel since June 16. After three attempts to break the upper edge, gold attracted some dip-buying on Monday following filling the weekly bullish gap. It rose to a fresh daily high during the early European session. Last seen trading around $1,840, bulls are still awaiting sustained strength beyond the channel's upper line.

As a result of the recent sharp decline in commodity and energy prices, inflationary concerns have now been eased. Moreover, some high-frequency data indicate a slowdown in US growth momentum. As a result of this, investors reassessed the prospect of more aggressive Fed rate hikes on Monday, dragging the US dollar to over a one-week low while helping dollar-denominated gold.

Several countries, including the US, UK, Japan, and Canada, plan to announce a ban on new gold imports from Russia during the G7 summit this week. This was seen as another factor that supported the XAUUSD. Despite this, the upside is still restricted, at least for the time being, as equity markets have gained strength, driving flows away from traditionally safe-haven XAUUSD.

From a technical perspective, the upper line of the falling channel may cap the rally, with sellers retaking control for targeting the 200-EMA around the 1834 hurdle.

If that is the case, the channel will be kept valid, and the price will find a way towards the lower edge of the channel, which lines up with the 1816 previous level of interest.

Otherwise, should buyers gain enough momentum to overstep $1840, breaking above the channel's resistance, the price can move up to meet $1845, which has proved to be significant resistance in the past.

Short-term momentum indicators are still pointing in favour of buying forces. RIS is trending upward in the buying area above the 50-level. Momentum is hovering above the 100-threshold, but its bullish run seems to be losing steam.MACD bars are advancing in positive territory above the signal line, hinting at a bullish bias in the market.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.