Gold buyers target the range’s border to reverse the short-term trend

Gold in bullish outlook,

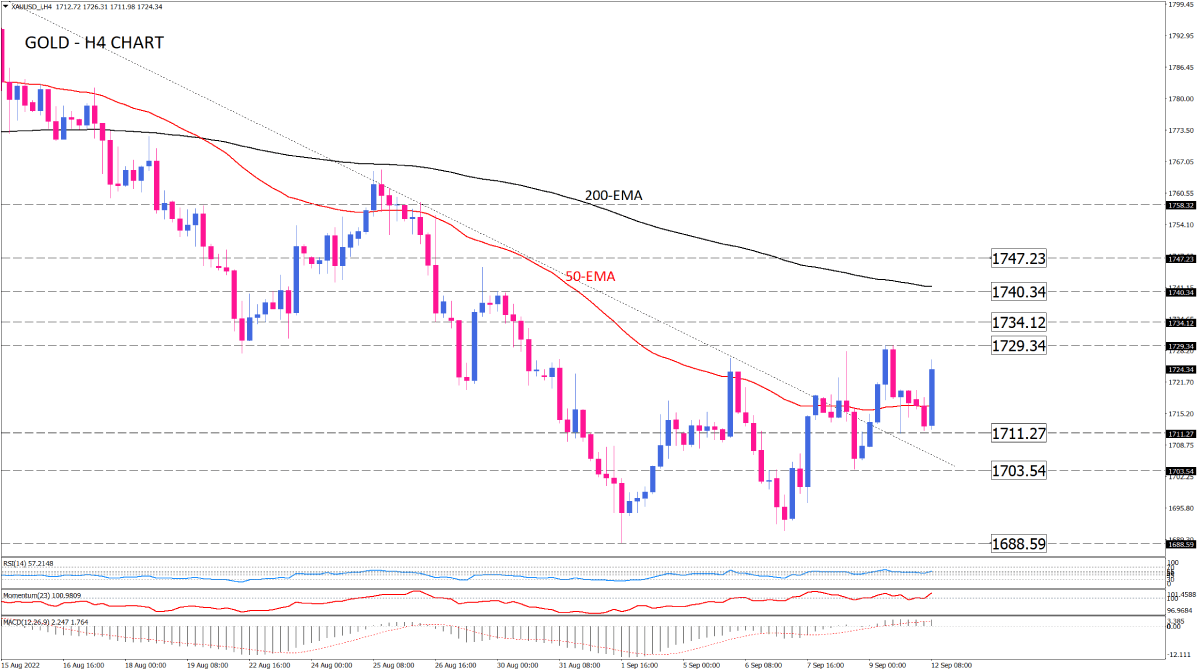

Due to the lack of persistent bearish sentiment, gold is currently trading sideways between the 1711.27 and 1729.34 levels. This rangebound has come into play as the precious metal managed to withstand the sellers’ pressure when the downtrend, which started on August 10, was stalled by a hit at 1688.59 in early September.

A waning bearish bias has led the price to penetrate the descending trendline. However, bulls need to gain further strength to face the 1729.34 hurdle. A successful breach of this level will impose a bullish outlook in the short term. Such a move will encourage more buyers to drive the market towards 1734.12. If buyers clear this obstacle, the 200-EMA can confront the rally on the verge of 1740.34. If this latter can’t hold resistance, gold will establish a new uptrend, aiming for 1747.23 and higher.

On the downside, should gold sellers manage to defend the range resistance, the price may fall back down, turning attention to the 1711.27 barrier.

Momentum oscillators indicate a cautiously bullish bias over the short term. The RSI is hovering at the upper boundary of the neutral zone, struggling to rise. The momentum, however, is pointing up in the buying region. As well, MACD bars remain slightly positive on the upside.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.