Gold picks up momentum amid escalating Russia-West tensions

The Russia-Ukraine conflict heavily influences risk-off sentiment, with gold attempting to reclaim the peak of August 2020 at 2020 dollars. Bloomberg reported that the US was looking to ban Russian oil imports, which could escalate tensions and lift the risk even higher. Also, A new wave of popularity in gold emerged after the cryptocurrency exchanges restricted trading for Russian residents.

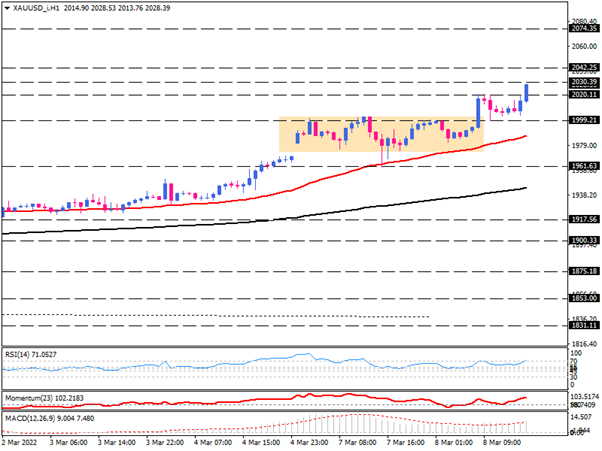

Gold posted another breakout in the European morning session on the one-hour chart, pushing above the 2,000 psychological barrier. Sellers restrained the market after it hit 2020, and currently, we can expect them to retest 2000 again. However, as long as gold buyers can maintain this level, the overall outlook for gold remains positive.

The 2011 dollars will become immediate resistance if they gather enough strength to drive the market higher. Eventually, the steady climb above this barrier will signal the return of buyers seeking to reach the 2020 mark. Prevailing bullish momentum will likely lead to a focus on the 2030 resistance level. Taking away this obstacle would encourage more buyers to enter the market. To reclaim the historical 2074 peak, they first need to rise above the 2042 barrier. Gold is currently enjoying a strong rally due to inflationary expectations and the ongoing conflict. Still, if the market risk decreases, the price may break through the critical support of 2,000.

As sellers return to their seats, the 1980 barrier, which aligns with the 50 EMA, will become the focus. A substantial holding of this barrier will limit further price depreciation. But if it fails to hold, then sellers will be watching Monday's price floor of 1961.

The short-term momentum oscillators indicate fading bullish sentiment. The RSI has deviated slightly from the overbought area, hovering in buying territory. Momentum has pulled back from 100-baseline, pointing upwards. The flattened positive MACD bars are located slightly above the signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.