NZD/CHF is headed towards two-week lows

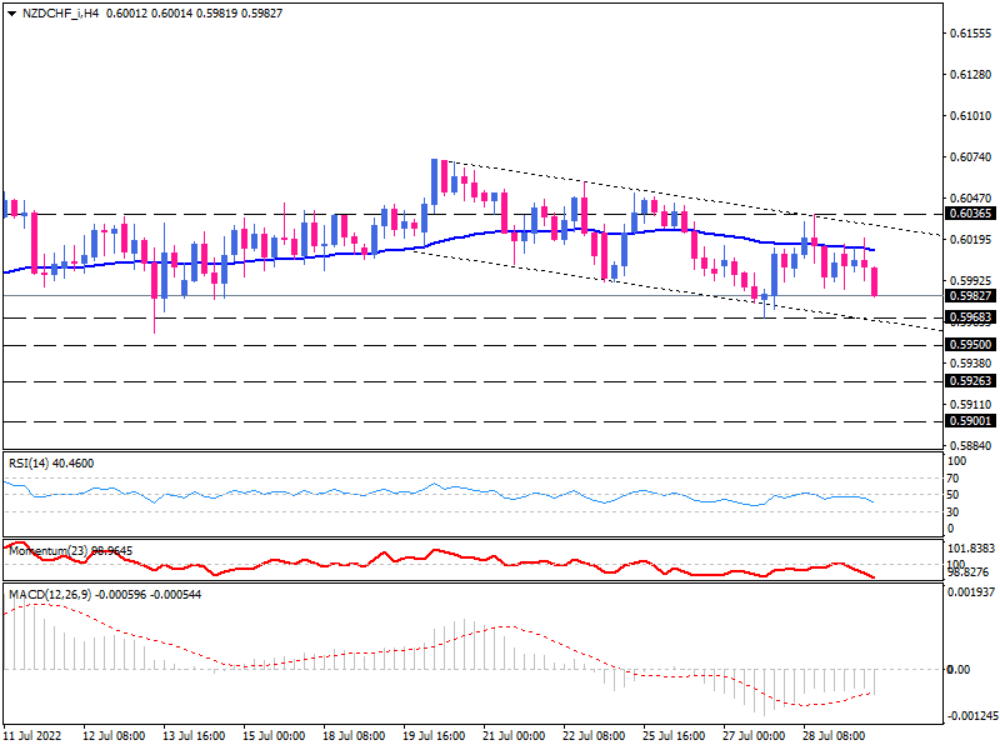

On Friday, NZD/CHF on the four-hour chart is trading in a mild downtrend with sellers attempting to settle the price below the 50-period exponential moving average. Connecting lower tops and lower bottoms has resulted in a negative sloping trendline, implying an approximate price path to the downside.

If selling pressure intensifies, Kiwi may continue to drop against the Swiss Franc and test the market bottom around two-week lows at 0.59683, which is in line with the channel’s lower border. The confluence of supports can lead the bears to take a breather and have the price consolidate upside. By overcoming this barrier, the price will likely fall further towards the 0.59500 mark within the descending channel. Sellers may be able to continue the bearish momentum if this obstacle can be cleared. In consequence, such a move would keep them optimistic about achieving 0.59263.

Alternatively, should NZD/CHF gain some upside traction, buyers would be back into action to target the channel’s upper line. Still, to reverse the trend, they need to break the previous top at 0.60365 to make a new higher top.

Short-term momentum oscillators suggest that bearish bias is growing. As RSI is moving down in the selling region, momentum has a reading of less than 100, and MACD has been posting negative values for some time.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.