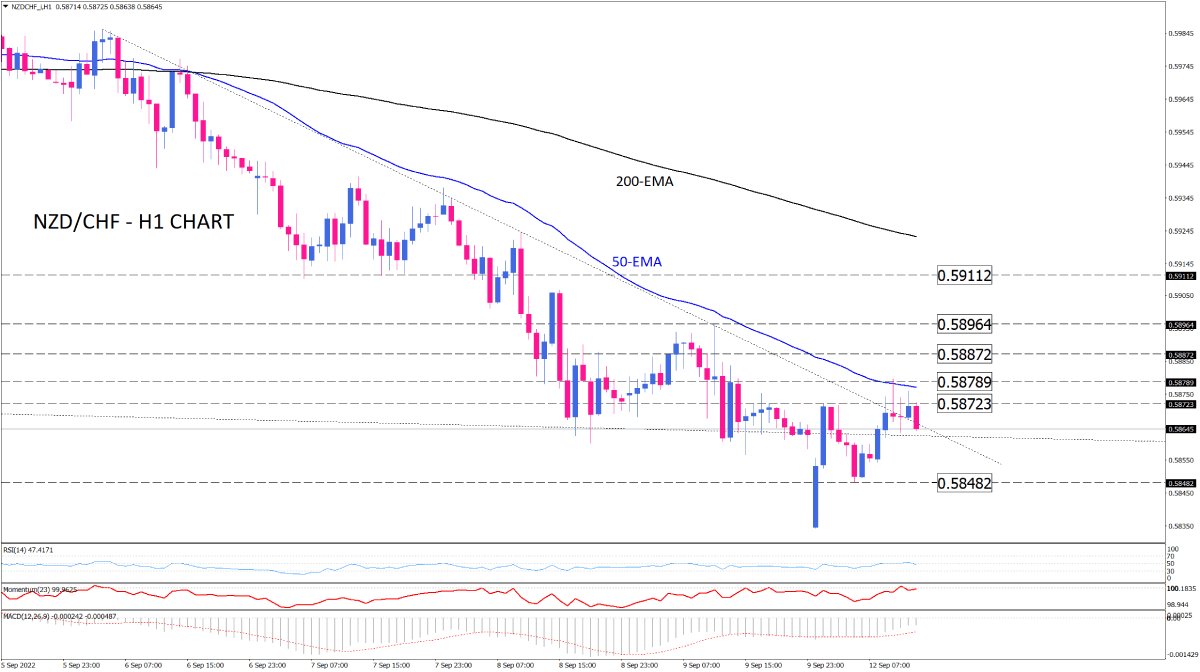

NZD/CHF sellers struggle to maintain the downtrend

NZD/CHF appears to be drawing a downtrend in the one-hour time frame. After tackling the downtrend line, the pair now faces the dynamic resistance of the 50-EMA, lining up with 0.58789.

Should sellers retake control to hold resistance around the 50-EMA, the price can turn down towards the 0.58482 previous level of interest. A further decline below this handle will negate the possibility of establishing a new uptrend.

Otherwise, if the New Zealand dollar bids higher against the Swiss Franc, buyers may be able to gain ground above the average, hoping to achieve 0.58872 as an immediate target. Getting over this hurdle will lead to 0.58964. Bulls will need to step over this level to take on the 200-EMA, which stands around 0.59113.

Short-term oscillators suggest that bearish sentiment is fading. RSI has moved back up toward the 50 threshold, and momentum has been recovering from its earlier troughs. Negative MACD bars are shrinking above the signal line toward zero.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.