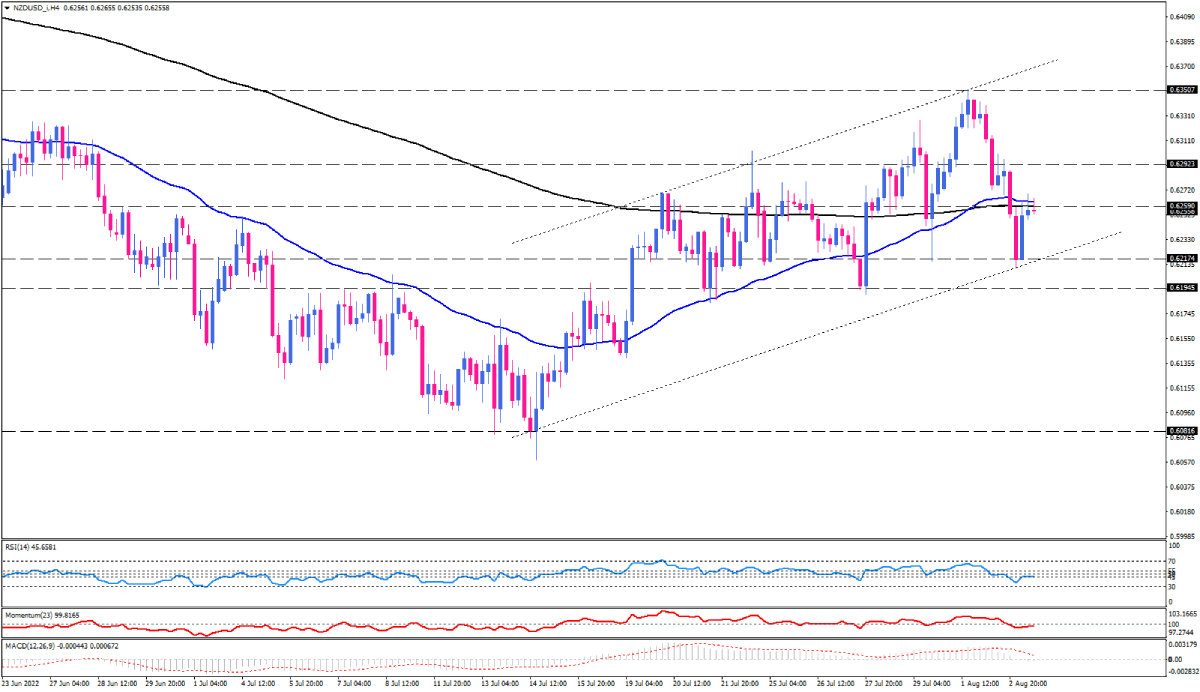

NZD/USD bulls are struggling with a key resistance zone

NZD/USD has been trading in an ascending channel since mid-July. After a sharp decline this week, NZD/USD bounced back from the channel’s support line and is now struggling to cross above the moving averages, which are in line with the 0.62590 mark.

The rally stalled as a hawkish stance from Fed officials supported the US dollar to rise against its rivals. However, bulls may keep momentum if upcoming Services PMIs in the afternoon print worse-than-expected numbers, resulting in a weaker dollar. A further push above the EMAs zone would speed up the rise towards the intraday level of interest at 0.62923. If buying forces persist in clearing this obstacle, they will be able to reclaim the six-week high of 0.63507.

Otherwise, if sellers defend the resistance confluence zone at the boundary of the 50 and 200-period exponential moving averages, the pair may dip back to retest the channel support line around the 0.62175 hurdle. A decisive break below the channel line can trigger a bearish reversal, sending the price towards 0.61945.

Short-term momentum oscillators reflect a mixed picture, suggesting the price can consolidate at the current level for some time. RSI has moved in the neutral zone, indicating a balance between buyers and sellers. Momentum is pulling up towards the 100-threshold, pointing out buyers need to recover their strength to take over the market. While, MACD bars have crossed the zero-line downside, signalling prevailing bearish sentiment.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.