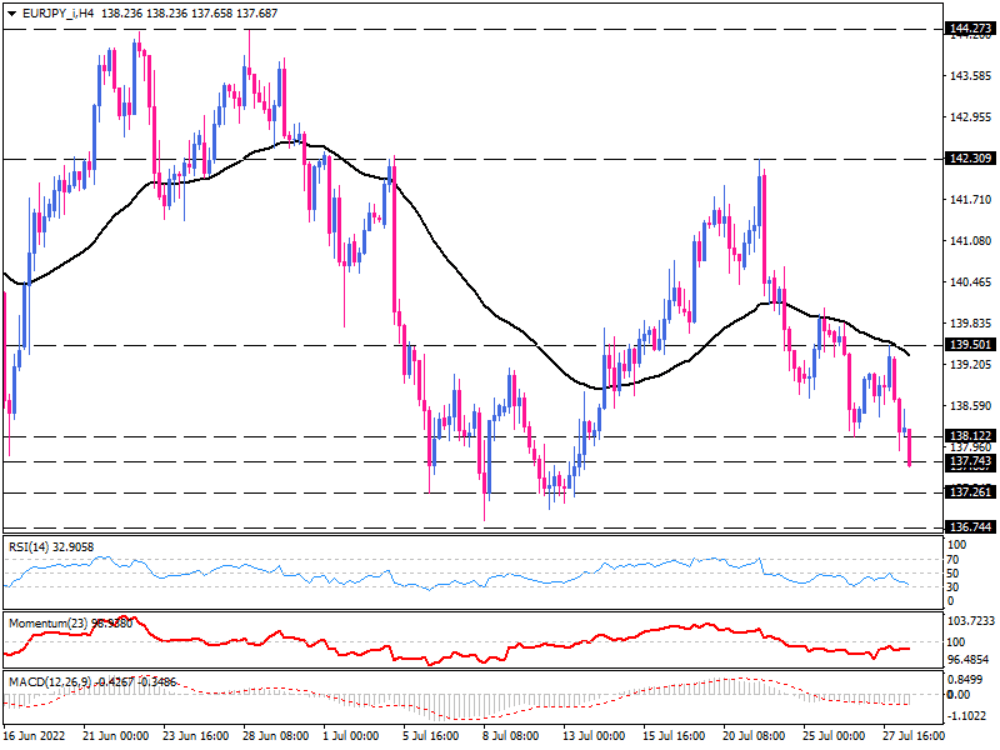

Selling forces drive down the EUR/JPY

As we can see on the four-hour chart, after topping out at 142.310, bearish momentum has been accelerating with sellers dragging the EUR/JPY below the 50-EMA, making lower tops and lower bottoms. Thursday's trading session continued with another breakdown of a significant support level at Wednesday's bottom at 138.122. The pair appears to be falling towards the 137.261 mark as the downtrend continues. If sellers remain in charge, they will overcome this hurdle, aiming for 136.744, which stands around the two-month low.

Otherwise, should buyers retake control, EUR/JPY could find a chance to pull up towards 139.501. However, the downtrend would remain intact unless buying forces make a sustained move above that key resistance, which is in line with the 50-period EMA.

As short-term momentum oscillators indicate, bearish momentum is still in play. RSI is pointing down after bouncing back from the 50-level. Momentum is indicating a slight cooling in negative sentiment, but it is remaining below the 100-threshold, which means sellers are still in control. The MACD value is also negative, and the MACD bars are approaching the signal line and may cross it downward if selling forces increase.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.