The cautious mood weighs on AUD/USD

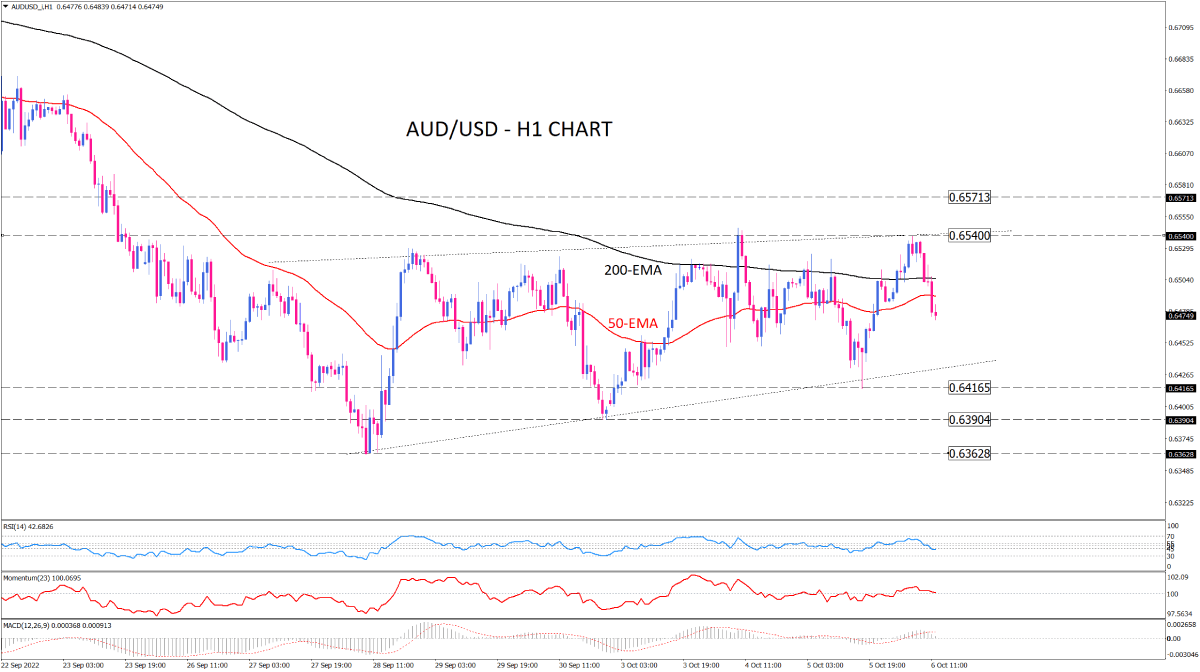

As seen on the one-hour chart, AUD/USD downtrend has been cooling down after the 0.63628 barrier put a stop at more declines around two-year lows. However, a lack of bullish sentiment has kept the pair in a pretty consolidation pattern since then with recent bouncing between the 0.65400 resistance and the 0.64165 support level.

There are several factors supporting the revival of US dollar demand, which keeps a lid on the pair's early positive movement toward the 0.65400 supply zone. Several Fed officials recently expressed hawkish views, reinforcing expectations that the US central bank will tighten monetary policy more rapidly. The market has even priced in the possibility of another supersized 75 bps Fed rate hike in November.

The pair is already in correction mode, trading below the 50-hour and 200-hour EMAs. If sellers hold their ground, AUD/USD can drop further towards the pattern’s lower border, which is in the vicinity of the previous bottom around 0.64165.

Traders may, however, choose not to place aggressive bets ahead of Friday's closely watched US employment report. Any clear directional signal will be triggered only when the price becomes able to break the wedge pattern to the either upside or downside.

Short-term momentum oscillators show mixed feelings. RSI supports the bearish vibe by oscillating below the 5-level. But momentum is pointing down in buying region. MACD also hint at fading bullish bias with MACD bars decreasing in the positive region.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.