The Golden Enigma: A Tale of Uncertainty, Inflation, and Opportunity

As the U.S. Dollar Index reaches new heights, gold prices find themselves slipping into the shadows, inching closer to the $1,990.00 mark. The market's anticipation of a rebound in U.S. inflation, bolstered by solid labour conditions, fuels the anxiety of investors. Meanwhile, S&P500 futures suffer as expectations of the Federal Reserve's aggressive approach to tackling inflation loom large.

The Plot Thickens

The stage is set for a dramatic escalation as Fed Chair Jerome Powell is expected to push rates above 5% in response to a decreasing Unemployment Rate. With firms competing for fresh talent, higher earnings may become a necessity, further complicating the economic narrative.

In a surprising turn, the U.S. Treasury yields face mounting pressure, with 10-year yields falling to around 3.37%. As the story unfolds, Wednesday's U.S. inflation data will provide crucial insights into the unfolding drama.

With bated breath, the market eagerly awaits Wednesday's release of U.S. inflation data. While moderation in the headline Consumer Price Index is anticipated, core inflation may defy expectations with an unanticipated upside, driven by solid household earnings.

Gold's Technical Odyssey

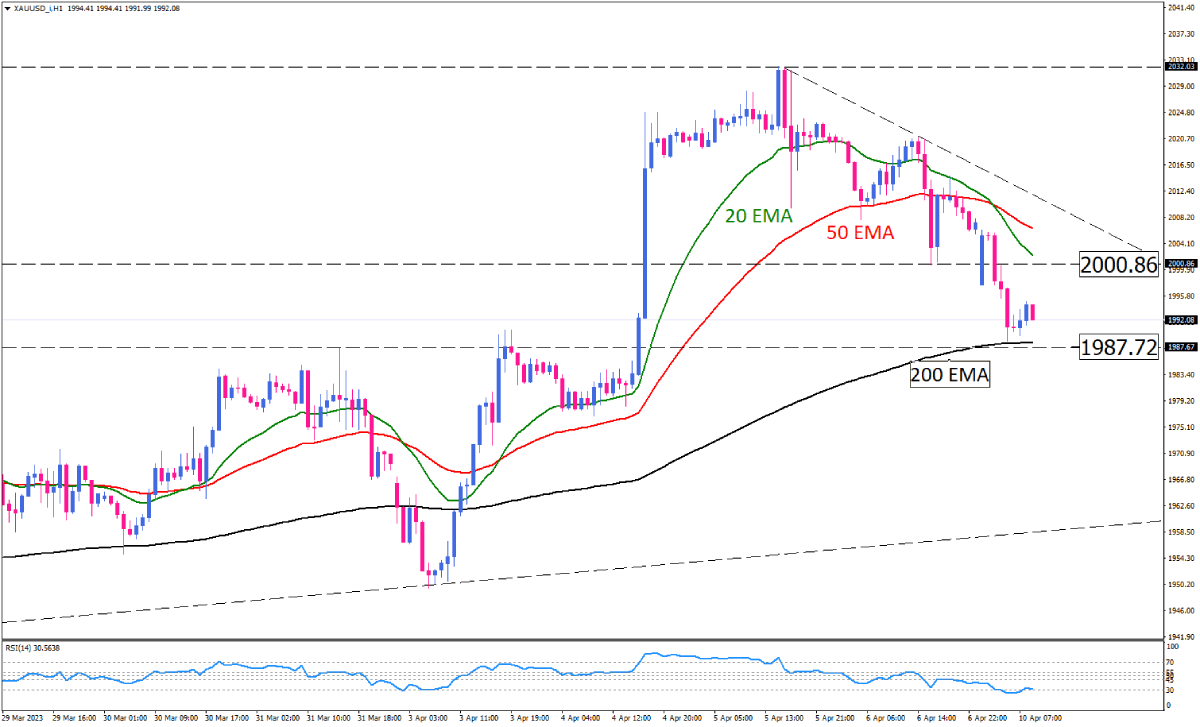

On the one-hour chart, as gold's price ventures towards the upward-sloping trendline, it leaves behind the comforting embrace of the $2,000.00 psychological support. The ominous bear cross, formed by the intersection of the 20-and 50-period Exponential Moving Averages, foreshadows potential weakness ahead. The Relative Strength Index's descent into bearish territory further illustrates the unfolding drama of gold's downward momentum. While sinking into the oversold area suggests that sellers may take a breath in the short term.

Even if the 200-EMA successfully holds support around 1987, buyers need to retake the ground above the $2,000 to overcome the sellers.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.