EUR/USD hit the wall of resistance at the one-week peak

As traders monitor geopolitical conditions and risk appetite trends, the Euro lost steam to keep ramping up. The improvement in the pair's outlook has been mainly due to recent speculation about the ECB hiking interest rates at some point.

However, IHS/Markit research's latest manufacturing activity survey showed on Monday that manufacturing activity in the Eurozone expanded, but less than expected. Despite upbeat PMIs figures earlier on Monday, geopolitical uncertainty has added to the Euro's woes. Eurozone Manufacturing purchasing managers index (PMI) reached 58.4 in February against expectations of 58.7 and 58.7 last month. It fell to a two-month low.

Conversely, service PMIs in the bloc jumped sharply in February to 55.8 from 52.0 predicted in January and 51.1 previously. This was the best reading in three months. The IHS Markit Eurozone PMI Composite rose to 55.8 in February vs 52.7 estimated and 52.3 previous. The gauge reached its highest in five months.

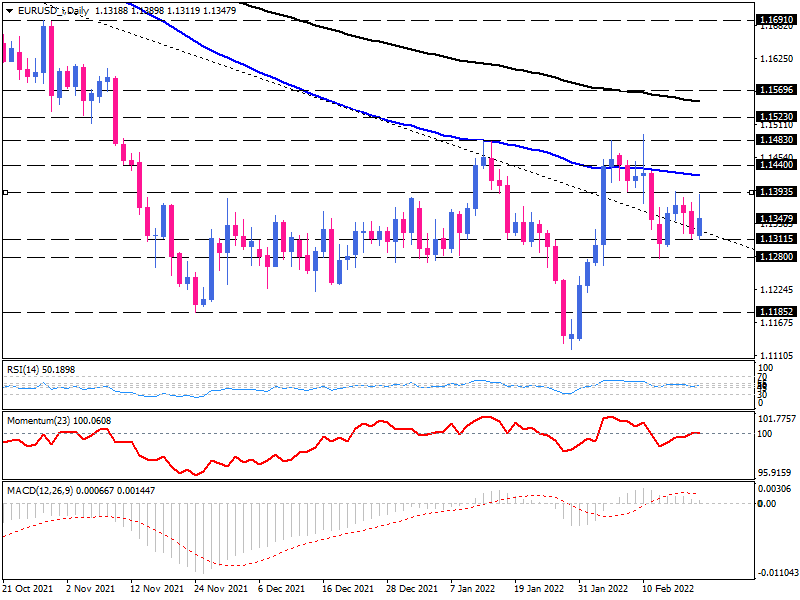

Daily view

In the wake of a weaker dollar, the Euro is on its way to reaching last week's high of 1.1395 after breaking above the downtrend line. The Euro will have the chance to keep above this severe barrier if the fundamentals support a risk-on mood. The buying forces will then be watching the 100-day moving average of around 1.14400.

Accelerating upward momentum could lead to clearing this roadblock and put the Euro back on track to reach its three-month highs of around 1.1483. This is a critical level for the Euro. If this resistance wall is broken, with the formation of a head and shoulders pattern, the conditions will be met for a bullish reversal.

Alternatively, the dollar's demand may grow as the geopolitical uncertainty persists. If that is the case, the pair could remain rangebound between the falling dynamic support of the broken trendline and last week's top at 1.1395.

Momentum oscillators also reflect a mixed perception. The RSI is fluctuating in the neutral zone, and momentum has had several round trips around the 100-baseline. Similarly, the MACD bars are shrinking very close to zero after a few positive and negative fluctuations.

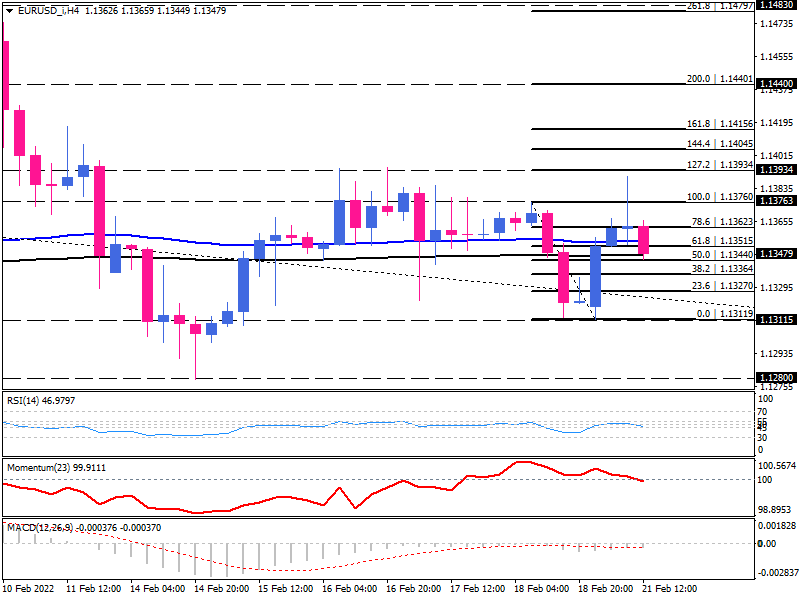

Short-term view

On the 4-hour chart, buyers have challenged the short-term resistance of 1.1376. If the price closes above this level, buyers will find a clue to strengthening the Euro. In that case, 1.1393 will be the immediate resistance. Clearing this barrier will pave the way to reaching the key psychological level of 1.1400. Holding the Euro above this psychological zone could drive the uptrend to 1.1415. By overcoming this resistance, 1.1440 will become accessible for buyers.

Otherwise, if the sellers retake control of the market, the Euro may fall to 1.1311. Breaking this support will dim the short-term outlook and encourage sellers to retest last week's floor at 1.1280.

Momentum oscillators indicate a relative balance between buyers and sellers. RSI tries to escape its neutral zone, and the momentum is attached to the 100-threshold. The MACD bars have been in line for a considerable time below the zero level.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.