EUR/USD trims losses as Fed holds rates, signals cautious stance

- EUR/USD climbs post-Fed, as policymakers keep rates unchanged but hint at a slower balance sheet runoff starting in April.

- Inflation remains “somewhat” elevated, with the Fed revising PCE and Core PCE higher, while GDP and unemployment estimates were lowered.

- Fed Governor Waller dissents, favoring an unchanged pace of balance sheet reduction, as markets digest mixed policy signals.

The EUR/USD spkied on Wednesday after the US Federal Reserve decided to keep interest rates unchanged despite adopting a slightly hawkish approach to the future path of interest rates. At the time of writing, the pair trades volatile within the 1.0860 – 1.0900 mark, down 0.49% on the day.

Pair trades volatile near 1.0860–1.0900 amid hawkish Fed outlook

In its monetary policy statement, the Fed commented that labor market conditions remain solid but emphasized that inflation remains “somewhat” elevated. The Committee mentioned that it would remain attentive to the risk of both dual mandates and will begin to reduce the pace of the balance sheet runoff in April.

The decision was unanimously approved, except for Fed Governor Christopher Waller, who favored keeping the balance sheet pace unchanged.

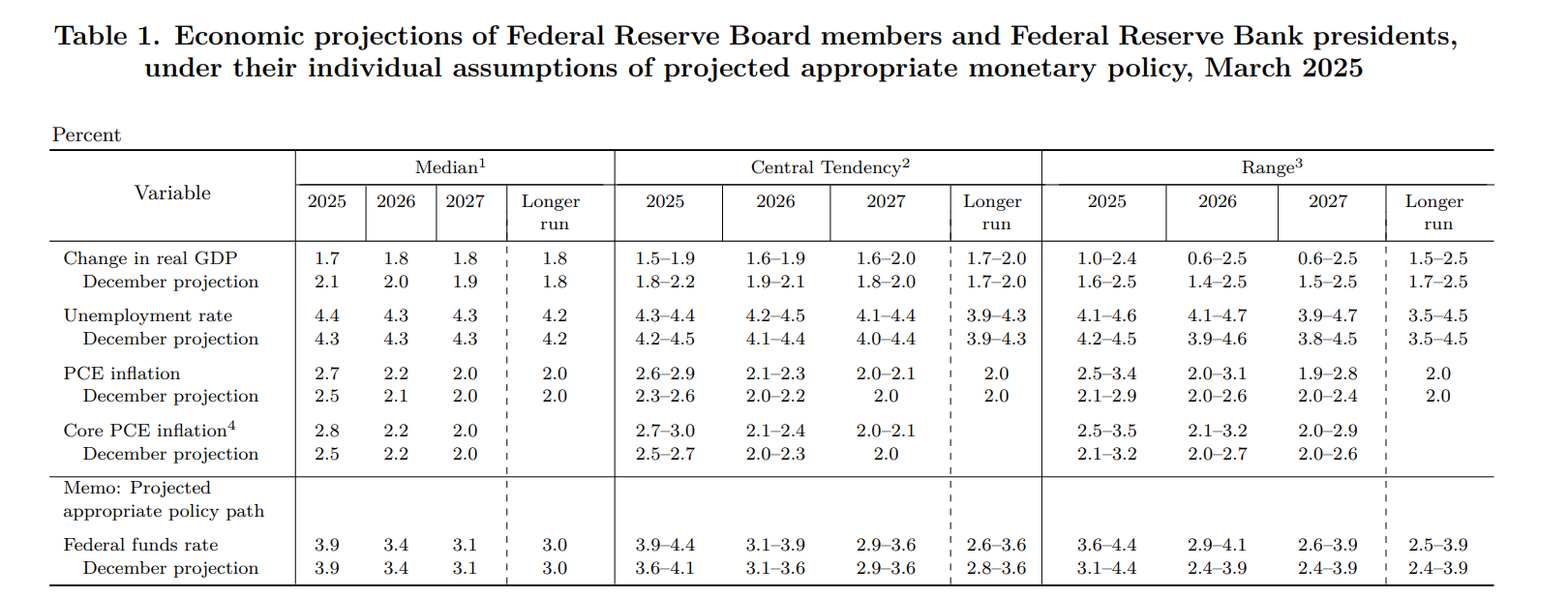

Regarding the Summary of Economic Projections (SEP), officials expect the fed funds rate to remain unchanged at 3.9% from December’s SEP while upwardly reviewing expectations on PCE inflation and Core PCE. On the other hand, the Gross Domestic Product (GDP) and the Unemployment Rate were downwardly revised.

Source: Federal Reserve

EUR/USD reaction to Fed’s decision

The EUR/USD dropped to 1.0862, before resuming to the upside, reaching 1.0892, but meanders within that range. Traders await the Fed Chair Jerome Powell's press conference at 18:30 GMT.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.45% | 0.12% | 0.15% | 0.18% | 0.34% | 0.48% | 0.22% | |

| EUR | -0.45% | -0.34% | -0.33% | -0.28% | -0.10% | 0.03% | -0.23% | |

| GBP | -0.12% | 0.34% | 0.04% | 0.07% | 0.25% | 0.37% | 0.10% | |

| JPY | -0.15% | 0.33% | -0.04% | 0.04% | 0.22% | 0.33% | 0.08% | |

| CAD | -0.18% | 0.28% | -0.07% | -0.04% | 0.18% | 0.32% | 0.03% | |

| AUD | -0.34% | 0.10% | -0.25% | -0.22% | -0.18% | 0.12% | -0.10% | |

| NZD | -0.48% | -0.03% | -0.37% | -0.33% | -0.32% | -0.12% | -0.27% | |

| CHF | -0.22% | 0.23% | -0.10% | -0.08% | -0.03% | 0.10% | 0.27% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.